Studies show people working into their “Golden Years” may not have saved enough for retirement

By Ken Bloom, J.D., LLM

I recently read a study about the employment growth rate of people 65 and older that that startled me. Since 2000 the percentage of adults employed in the workforce has steadily declined while the percentage of elderly Americans working has steadily increased.

The labor participation rate (the percentage of people aged 16 and above employed or seeking employment) peaked at 67.3% in 2000. The rate has fallen to 62.9% in November 2018. Since the workforce is aging (the oldest Baby Boomers began receiving Social Security between 2008-2012) it seems logical that the participation rate for older workers should have declined the fastest. However, the opposite has occurred.

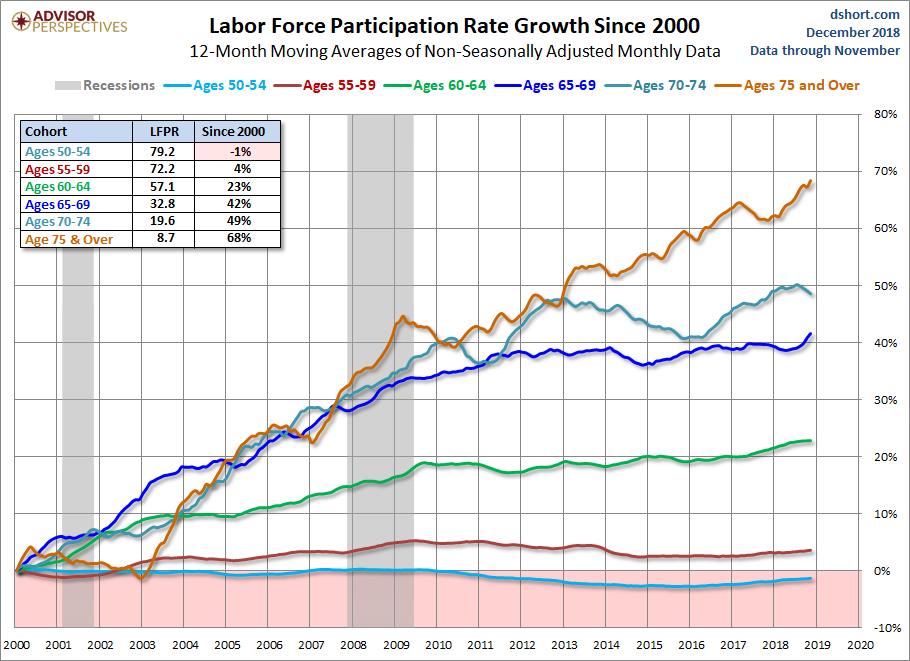

Look at the chart below:

Since 2000 the labor participation rate of those 75 and older has increased by an astonishing 68%. During the same time the labor participation rate for those ages 50-54 has declined. There are many reasons for these numbers, but I believe most people are surprised to see the results.

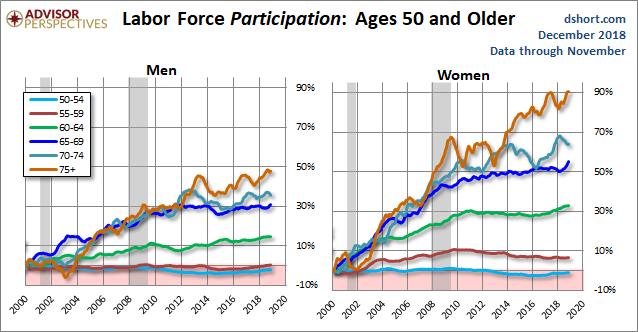

The increased participation rates for older Americans has especially affected women. As the chart below indicates, since 2000 the rate of women older than 75 in the workforce has increased by 90%. At the same time women 70-74 have experienced an increase of 60% in labor participation.

There are many reasons for people continuing to work after the traditional retirement age of 65 and many of the reasons are not financial. However, it is safe to say that many of the older workers are employed because they need the money. With the elimination of traditional pension plans, increased life expectancies, and the lingering effects of the great recession of 2008 it is expected these numbers will continue their upward trajectory.

In years past, we would talk about people 65 and older as being in their “Golden Years.” But today, that dream of a happy, comfortable retirement is not available for many Baby Boomers. Of course, some people like to continue to work as they age because they enjoy what they do or the social aspect it can bring to one’s life. Unfortunately, too many in these statistics work because they don’t have enough money saved to retire.

But even if you think you have saved enough to retire comfortably, you may be surprised how much you could spend enjoying your retirement years. That’s why it is important to review your lifestyle and potential expenses before retiring to ensure you can live those “Golden Years” the way you had planned. Here are some things to consider when you are saving for retirement:

Determine What You Need to Maintain Your Lifestyle – For years, retirement experts would tell people they needed to have 70% - 80% of their pre-retirement income each year to live comfortably in retirement. While that may be enough for people who aren’t planning to be very active in retirement, it may be too little for people who want to maintain their current lifestyle. If you don’t plan to give up your regular vacations, season tickets for your favorite teams, the new car you like to lease every three years, or even that weekly shopping spree, having less money to live off may not meet your needs.

So do a thorough analysis of your current household expenditures for the past few years, and then determine what things you can eliminate during retirement and which are a necessity to maintain the lifestyle you want to live. And recognize that retirement lifestyle is not the same for everyone. Some people don’t want to travel and are fine living with less in retirement. Whatever your choice is, it is still vital to review your expenditures and financial situation to develop a savings plan that will meet your needs.

Review Your Current Savings and Retirement Funding Options- Once you have determined how much it will take you to live each year in retirement, then review your current retirement savings portfolio, any pensions you will qualify for, and even the amount of Social Security benefits you will receive at various stages of retirement, from 62 years old through your full retirement age and beyond. Next look at the number of years you have left until you plan to retire and how much more you can save during that time. If you have a funding gap that will make it difficult for you to live a comfortable lifestyle in retirement, you will need to determine what options are available to bridge that funding gap.

Among the things that you can consider while you are working is to maximize any 401(k), 403 (b) or other retirement plan options, especially if you work for an organization that matches your contributions. If you are 55 and older, you may also qualify to make catch-up IRA contributions that allow you to contribute more dollars than when you were younger.

If you are getting close to your planned retirement age but still enjoy working, you could continue to work until you save additional funds to help bridge the retirement funding gap. There is also the option of delaying taking Social Security benefits until your full retirement age or even later to gain larger monthly benefits when you do take it.

Once you have done an analysis of your current and projected expenditures and the retirement funds you will need, then you can map out a serious plan to retire in the fashion you want to live.

The Consequences of Living Longer in Retirement – The advancement in medical technology and the shift towards leading healthier lifestyles has helped people live longer, and that means they will need even more money in their retirement fund to maintain their lifestyle potentially into their 90s. So make sure you factor that into your retirement planning to ensure you don’t run out of money in retirement.

Once you are retired, you may also find that you don’t need the amount of money you originally thought. For years, investment advisors would recommend that people withdraw 4% from their retirement portfolio annually to ensure they don’t run out of money. But not everyone needs a 4% withdrawal, especially if a husband and wife are both getting large Social Security benefits, or have a pension. So only take out what you need each year, and adjust your withdrawals to take out less when you don’t need the money. That way you will have extra funds available if you do need the money for unplanned health costs or other expenses.

Don’t Worry About Healthcare Costs- While factoring in what your Medicare and other monthly healthcare costs will be is important for your retirement planning, you can’t foresee what the future may hold in terms of additional healthcare costs. For example, both my parents lived into their 90s and while my father didn’t require in-home nursing support during his later years, my mother did. Fortunately, they had saved enough to cover the costs, but you never know what healthcare services you may require. And as they aged, they also didn’t spend as much money on trips and other things that they did when they were younger. As a result, they had the money available to cover these unforeseen costs.

Of course, it is wise to save more than you think you will need to maintain your lifestyle, and have that reserve available if needed. But you can’t predict the future!

Be Flexible in Retirement-While planning for retirement and saving as much as you can is vital, I have learned that you will need to be flexible in retirement both with your lifestyle choices and your expenditures. For many people, the dream of buying a place in Florida or Arizona to retire to changes when their kids and grandkids end up moving to the West Coast or New York.

You may also realize you are bored in retirement and decide to get back into a new career that provides you with both a challenge and additional dollars every month. Either way, if you have done your due diligence prior to retirement, you will have a good chance to live comfortably when you do retire.